Different Types of Mortgages In Europe

Introduction to Mortgages in Europe

Mortgages in Europe play a vital role in facilitating homeownership, offering individuals the opportunity to purchase property by spreading the cost over an extended period.

Historical Overview of Mortgages in Europe

The concept of mortgages in Europe dates back centuries, with early forms emerging during the Middle Ages. Over time, mortgage systems evolved, influenced by economic conditions and legal frameworks.

Types of Mortgages Offered in Europe

Fixed-Rate Mortgages

Fixed-rate mortgages provide borrowers with stability, as the interest rate remains constant throughout the loan term, offering predictable monthly payments.

Variable-Rate Mortgages

Variable-rate mortgages, also known as adjustable-rate mortgages, have interest rates that fluctuate based on market conditions, offering the potential for lower initial rates but posing risks of increased payments in the future.

Interest-Only Mortgages

Interest-only mortgages allow borrowers to pay only the interest for a specified period, typically resulting in lower initial payments but requiring repayment of the principal amount afterward.

Tracker Mortgages

Tracker mortgages are linked to a specific benchmark, such as the European Central Bank’s base rate, with interest rates adjusting accordingly, providing transparency and responsiveness to market changes.

Mortgage Market Trends in Europe

The mortgage market in Europe experiences various trends influenced by economic factors, regulatory changes, and consumer preferences, impacting borrowing costs and accessibility.

Factors Affecting Mortgage Rates in Europe

Several factors influence mortgage rates in Europe, including central bank policies, inflation rates, economic growth, and geopolitical events, contributing to fluctuations in borrowing costs.

Mortgage Regulations and Policies in Europe

European countries implement diverse regulations and policies governing mortgages, aiming to ensure consumer protection, financial stability, and responsible lending practices.

Popular Mortgage Lenders in Europe

Numerous financial institutions offer mortgages in Europe, including banks, credit unions, and specialized mortgage lenders, each with distinct products and terms.

Advantages of Mortgages in Europe

Mortgages in Europe offer several advantages, such as facilitating homeownership, enabling property investment, and providing tax benefits and wealth accumulation opportunities.

Challenges and Risks Associated with Mortgages in Europe

Despite the benefits, mortgages in Europe also pose challenges and risks, including interest rate fluctuations, affordability issues, and the potential for over-indebtedness, requiring prudent financial management.

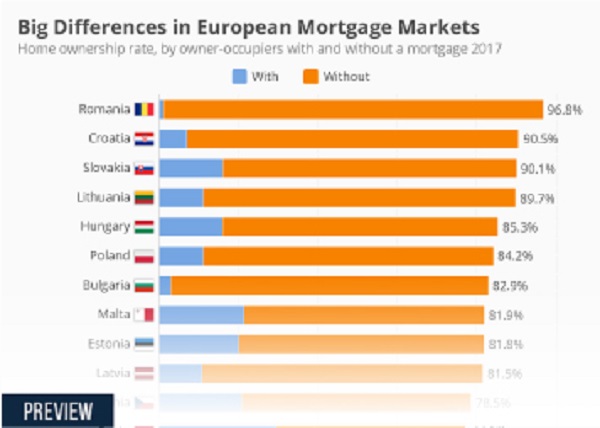

Comparison of Mortgage Systems Across European Countries

Mortgage systems vary across European countries in terms of lending criteria, interest rate structures, and regulatory frameworks, influencing accessibility and affordability for borrowers.

Future Outlook for Mortgages in Europe

The future of mortgages in Europe is shaped by technological advancements, demographic changes, and regulatory developments, with innovations such as digital mortgages and green finance gaining prominence.

Tips for Securing a Mortgage in Europe

To secure a mortgage in Europe, prospective borrowers should maintain a good credit score, save for a down payment, compare lenders and mortgage products, and seek professional advice to navigate the process effectively.

Impact of Economic Conditions on Mortgages in Europe

Economic conditions, such as interest rates, employment levels, and housing market dynamics, significantly impact the availability and affordability of mortgages in Europe, influencing borrowing decisions.

Cultural Attitudes Towards Mortgages in Europe

Cultural attitudes towards mortgages in Europe vary, influenced by historical, social, and economic factors, with some societies favoring homeownership as a symbol of stability and wealth, while others prioritize alternative forms of tenure.

Conclusion: The Role of Mortgages in Europe’s Housing Market

Mortgages play a crucial role in Europe’s housing market, facilitating property transactions, supporting economic growth, and enabling individuals to achieve homeownership aspirations, albeit with associated risks and challenges.

Unique FAQs

Can foreigners obtain mortgages in Europe?

Yes, foreigners can typically obtain mortgages in Europe, although requirements may vary depending on the country and lender. It often involves providing proof of income, residency status, and a down payment.

Are mortgage rates in Europe currently low?

Mortgage rates in Europe fluctuate based on various factors, but in recent years, historically low interest rates have been prevalent in many European countries, contributing to favorable borrowing conditions.

What are the typical loan terms for mortgages in Europe?

Loan terms for mortgages in Europe commonly range from 10 to 30 years, although shorter and longer-term options may also be available depending on the lender and borrower preferences.

Are there government incentives for homeownership in Europe?

Some European countries offer government incentives to promote homeownership, such as grants, subsidies, or tax benefits for first-time buyers, energy-efficient properties, or certain demographic groups.

How does Brexit affect mortgages for UK citizens buying property in Europe?

Brexit has implications for UK citizens buying property in Europe, potentially affecting access to mortgages, residency rights, and property ownership regulations, depending on the specific agreements between the UK and individual EU countries.